Long-Term Multi-Family Financing

Obtain long-term financing for 5 to 9-unit apartment buildings.

LOAN CRITERIA

Collateral: Multi-Family Apartment Buildings 5+ Units*

*Maximum 9 Units

Term: 30 Years

Amortization Options: 30-Year Fixed, Hybrid ARMS (5/1, 7/1, 10/1) & Interest-Only Options Available

Loan Amount: Minimum Value Requirement of $40k Per Door.

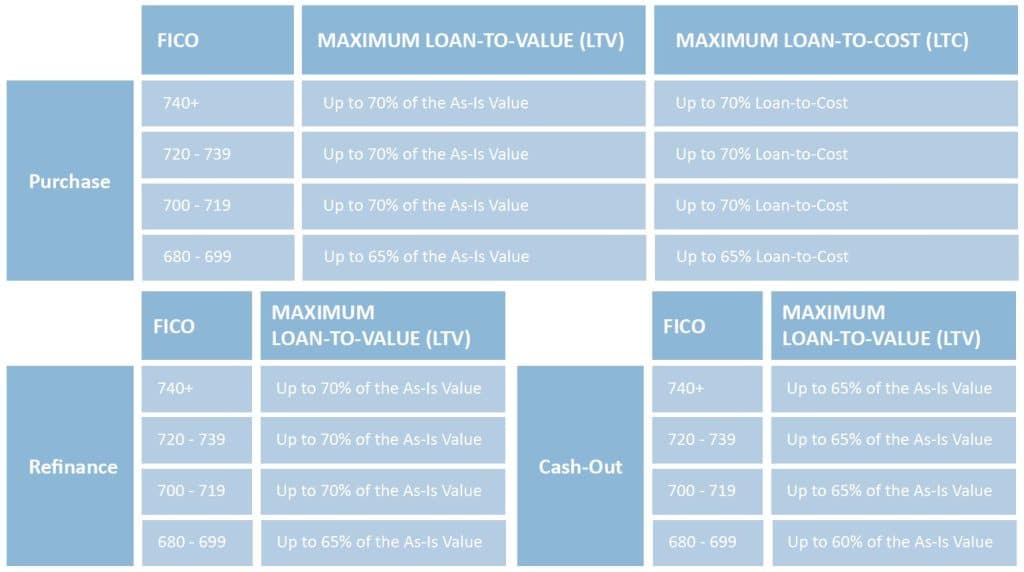

LTV:

Purchase: The Lesser of Up to 70% of the As-Is Value or Up to 70% Loan-to-Cost

Refinance: Up to 70% of the As-Is Value

Cash-Out: Up to 65% of the As-Is Value

Credit Score: 680 Minimum

Fast Financing that Fits Your Real Estate Investments

Leverage Based On Credit Score

Long-Term Multi-Family Financing with One West: Tailored Solutions for Real Estate Investors

Are you looking to invest in multifamily properties and need flexible, reliable financing? At One West Hard Money, we specialize in long-term multifamily financing solutions designed to help real estate investors build wealth through multifamily property ownership. Whether you’re purchasing a duplex, triplex, or a large apartment complex, our customized loan options provide the capital you need to grow your real estate portfolio and maximize your returns.

Why Choose One West for Long-Term Multi-Family Financing?

At One West, we understand the unique opportunities and challenges that come with investing in multifamily real estate. Our multifamily financing solutions are designed to offer competitive rates, flexible terms, and fast approvals, allowing you to capitalize on investment opportunities quickly. Here’s why investors trust One West:

- Flexible loan terms

Our long-term multifamily financing options offer terms ranging from 5 to 30 years, providing stability and predictability for your investment. - Fast approvals

We streamline the loan process, offering quick approvals so you can secure your next multifamily property without delays. - High loan amounts

Borrow up to 80% of the property’s value, helping you maximize your leverage while maintaining manageable monthly payments. - Simplified approval process

We focus on the income-generating potential of your multifamily property, not just your credit score, making it easier for you to qualify. - Local expertise

With years of experience in the St. Louis real estate market, we provide valuable insights and financing solutions tailored to local investors.

What Is Long-Term Multi-Family Financing?

Long-term multifamily financing refers to mortgage-style loans specifically designed for investors purchasing or refinancing multifamily properties. These properties typically include duplexes, triplexes, fourplexes, and larger apartment complexes. Our financing options are structured to offer long-term, stable funding, making them ideal for investors seeking to generate consistent rental income.

At One West, our long-term multifamily loans are perfect for:

- Small multifamily properties (2-4 units)

- Large apartment complexes (5+ units)

- Mixed-use properties combining residential and commercial units

- Portfolio loans for multiple multifamily properties

- Refinancing existing multifamily mortgages

While traditional lenders offer products like FHA multifamily loans and HUD multifamily loans, One West provides faster approvals, more flexible terms, and personalized solutions ideal for real estate investors who want to move quickly in today’s market.

Benefits of Long-Term Multi-Family Financing with One West

- Consistent cash flow with predictable payments

Our long-term multifamily loans offer fixed interest rates and extended terms, ensuring predictable monthly payments and steady cash flow from rental income. - Maximize your investment potential

Borrow up to 80% of the property’s value, allowing you to expand your portfolio and generate greater passive income from your multifamily housing investments. - Flexible financing for diverse properties

Whether you’re purchasing a duplex, a triplex, or a large apartment building, our financing solutions can be tailored to meet your investment goals. - Refinancing options for better rates

If you already own a multifamily property, our refinancing options can help you secure better rates, reduce monthly payments, or pull out equity for new investments. - Support for portfolio growth

Our multifamily financing solutions support long-term growth, allowing you to acquire additional properties and build a robust real estate portfolio.

How Does Long-Term Multi-Family Financing Work?

At One West, we make the financing process simple and efficient, ensuring you get the funds you need to secure your next multifamily investment.

- Initial consultation and pre-approval

Submit basic information about your multifamily property and investment goals. We’ll review your application and provide pre-approval within days. - Property evaluation and income assessment

We assess the property’s value and rental income potential to determine the loan amount and terms that best fit your investment strategy. - Loan approval and funding

Once approved, we finalize the loan terms and disburse funds quickly, enabling you to close on your multifamily property without delays. - Long-term loan management

Enjoy predictable payments and flexible refinancing options as you grow your multifamily housing portfolio.

Who Can Benefit from One West’s Long-Term Multi-Family Loans?

Our long-term multifamily financing solutions are designed for:

- New real estate investors purchasing their first multifamily property

- Experienced investors expanding their portfolios with duplexes, triplexes, or large apartment buildings

- Mixed-use property owners seeking flexible financing for combined residential and commercial properties

- Portfolio investors managing multiple multifamily properties under one loan

- Property owners looking to refinance existing multifamily mortgages for better rates or cash-out opportunities

Frequently Asked Questions About Long-Term Multi-Family Financing

What is considered a multifamily property?

A multifamily property typically consists of two or more residential units within a single building or complex. This can include duplexes, triplexes, fourplexes, and larger apartment complexes.

How much can I borrow with a multifamily loan?

We offer up to 80% loan-to-value (LTV) for qualifying multifamily properties, helping you maximize your investment potential while maintaining manageable payments.

Can I refinance an existing multifamily mortgage?

Yes! Our long-term multifamily financing options include refinancing solutions to help you secure better rates, pull out equity, or consolidate existing debt.

Do you offer FHA or HUD multifamily loans?

While we don’t offer government-backed products like FHA loans or HUD multifamily loans, our hard money loans provide faster approvals, flexible terms, and customized solutions that are ideal for investors looking to move quickly in competitive markets.

How quickly can I get approved for a multifamily loan?

Our streamlined process allows for pre-approval within days, and funding can be secured quickly to help you close on your multifamily property without delays.

Get Started with St. Louis’ Leading Multi-Family Financing Experts

At One West Hard Money, we are dedicated to helping real estate investors succeed in building and managing profitable multifamily housing portfolios. With flexible loan options, fast approvals, and deep local expertise, we are your trusted partner in long-term multifamily financing.

Contact us today to learn more about how our multifamily property loans can help you grow your real estate investments. Call us at (314) 887-5834 or email loans@onewesthardmoney.com to get started.